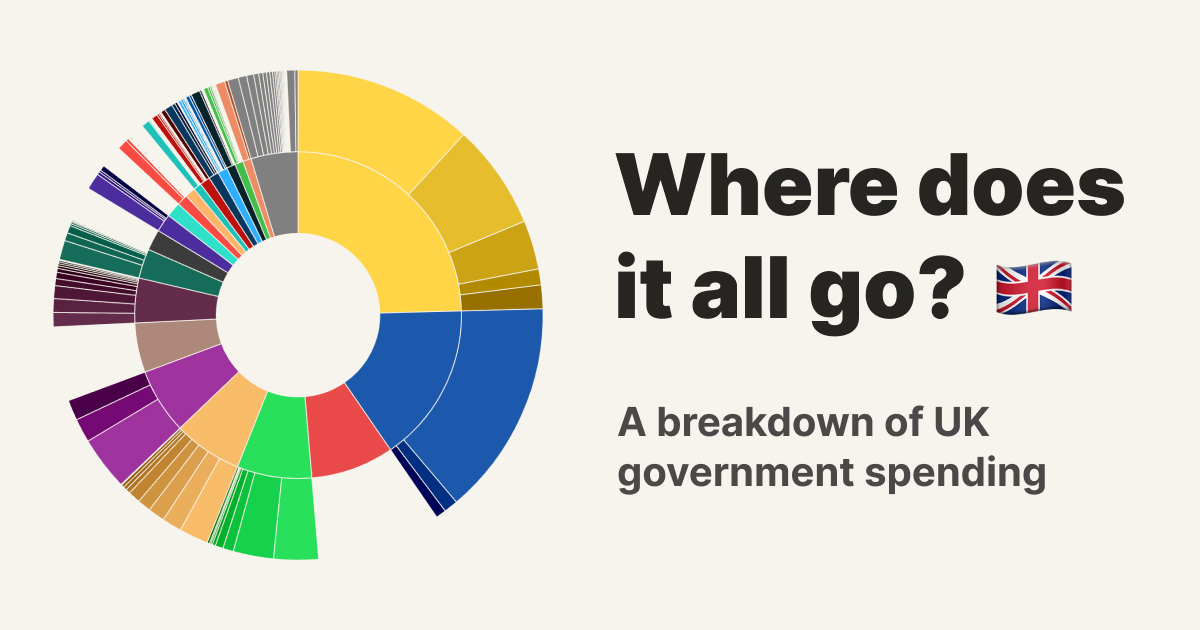

What a great resource! And wow 😳! That debt interest repayment. Fuuuuck.

Also:

An uncomfortable truth is that today’s pensioners are often better off than young working families.

That debt interest repayment. Fuuuuck.

The interest is less a issue then media indicates.

Its 8+ % of the total annual spending. And while you can’t judge nstional debt like family debt. The maths is far different.

Most families with a mortgage are paying a higher % on their income on interest to the mortgage, car loans and credit cards etc. And getting much less money in result.

When a government borrows the interest rate is fixed at the time of borrowing. And that rate promised for the lifetime of the bonds/loan. As such they are able to get much much lower rates then you or me.

The issue that is worring them no is any new loans are at our current credit rating. IE crap. And our growth rate is lower then the interest rate we would get. This means borrowing more money now is expensive. Whereas whe we borrowed our current debt it was cheap. Growth in gdp and lowering of the £ all make paying back loans(or bonds way cheaper then the value of the money when borrowed. This with the low interest. Means most of that payment is free when compared with the growth it purchased since ww2.

But we borrowed a lot during covid. And failed to use it to invest i our economy. (It went into billionaires savings atcway higher % then any past borrowing).

Inflation would actually help the gov borrow cheaper for future investment. But also likely lose them power as it screws over UK the poor and rich alike.